salt tax deduction california

The entitys qualified net income is the sum of the pro rata or distributive shares of income for any of the entitys qualified taxpayers. 113 signed by Governor Gavin Newsom makes several important tax changes including expanding the availability and benefit of the states pass-through entity PTE tax credit with most provisions taking effect during the 2021.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The average amount of that deduction was 1718333.

. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California. Effective for tax years 2021-2025 the Small Business Relief Act. Governor Newsom signed California AB 150 allowing owners of passthrough entities exception to 10000 federal cap on state and local tax SALT deductions for individuals.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted elective pass-through entity PTE tax legislation. 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction. The Tax Cuts and Jobs Act passed in 2017 limits an individuals annual federal deduction for SALT paid to 10000 for tax years 2018 through 2025.

Then in December 2017 The Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 thereby limiting a taxpayers itemized deductions and tax benefits. In 2014 3386 of California returns included a deduction for state and local taxes. California Enacts SALT Workaround.

California SB104 seeks to. In response to the federal state and local tax SALT deduction 10000 cap enacted as part of the Tax Cuts and Jobs Act TCJA California Governor Gavin Newsom signed budget legislation AB. AB 150 calculates the tax to be paid by a qualified entity by multiplying the entitys qualified net income by a tax rate of 93.

Like other SALT workarounds Californias. California Income Tax Deduction. Eliminates NOL Suspension and 5 Million Credit Limitation.

Most people do not qualify to itemize. California Passes SALT Cap Work-Around. SB 113 which Governor Gavin Newsom signed into law on February 9 2022 expands the states workaround of the federal deduction limit for state and local taxes SALT and repeals the net operating loss NOL suspension and.

This elective tax is in addition to and not in place of any other tax or fee. Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers. The average California SALT deduction was 1714835.

3 California does allow deductions for your real estate tax and vehicle license fees. On July 16 th the Governor signed AB 150 a budget trailer bill containing language outlining Californias PTE tax guidelines that. California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes known as SALT limitation with the enactment of AB150 recently signed by Governor Gavin Newsom.

Adding the 10000 cap increases the payment of an average California taxpayer who previously took the full SALT deduction by about 4000 according to a statement against the changes by several California mayors. If you want to take advantage of the workaround for the 2021 tax year you must take action by March 15th 2022. 2 California does not allow a deduction of state and local income taxes on your state return.

While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step toward allowing many of its residents to mitigate the effects. That households so high on the income spectrum can expect a net tax cut from the Build Back Better Act is entirely due to the increase in. On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass-through entities PTE from the current individual annual 10000 limitation on the deduction against federal taxable income for state and local taxes SALT paid.

On July 16 Governor Newsom signed into law Assembly Bill 150 the Bill or AB-150. The IRS is expected to issue guidance later in 2018 on these SALT limit workarounds. Its no surprise then that 41 of New Jersey tax returns claimed a deduction for state and local taxes.

SALT deduction California California is considering similar SALT Deduction legislation while Connecticut already enacted similar legislation earlier this year. 150 that includes a pass-through entity workaround for tax years beginning on or after January 1 2021. In a progressive state with high taxes many are discovering the bite the 10000 SALT cap is.

People that resided in high tax states such as California found themselves leaving deductions on the table as they frequently paid far more than 10000 in SALT. California Expands SALT-Cap Workaround. California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and local taxes paid for individuals that was established by the Tax Cuts and Jobs Act of 2017 TCJA.

1 Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately. California has taken a welcome step towards allowing certain business owners to mitigate the effects of the 10000 federal limit on the SALT deduction limitation implemented under the Tax Cuts and Jobs Act. As the first Tax Day without unlimited state and local tax deduction approaches an estimated 1 million California families will pay 12 billion more to Uncle Sam.

As we all know the Tax Cuts and Jobs Act of 2017 TCJA essentially eliminated the state and local tax SALT deduction availabe to individual taxpayers capping the amount deductible to 10000. The California SALT deduction workaround passed July 16th 2021 with the California Budget and will be effective from 2021 to 2025.

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

Stump Articles State And Local Tax Deduction Who Wins Who Loses 19 October 2017 18 24

Poppy California Flower Bath Salt Flower Bath Floral Bath Salts Himalayan Pink Salt

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

State And Local Tax Salt Deduction Salt Deduction Taxedu

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

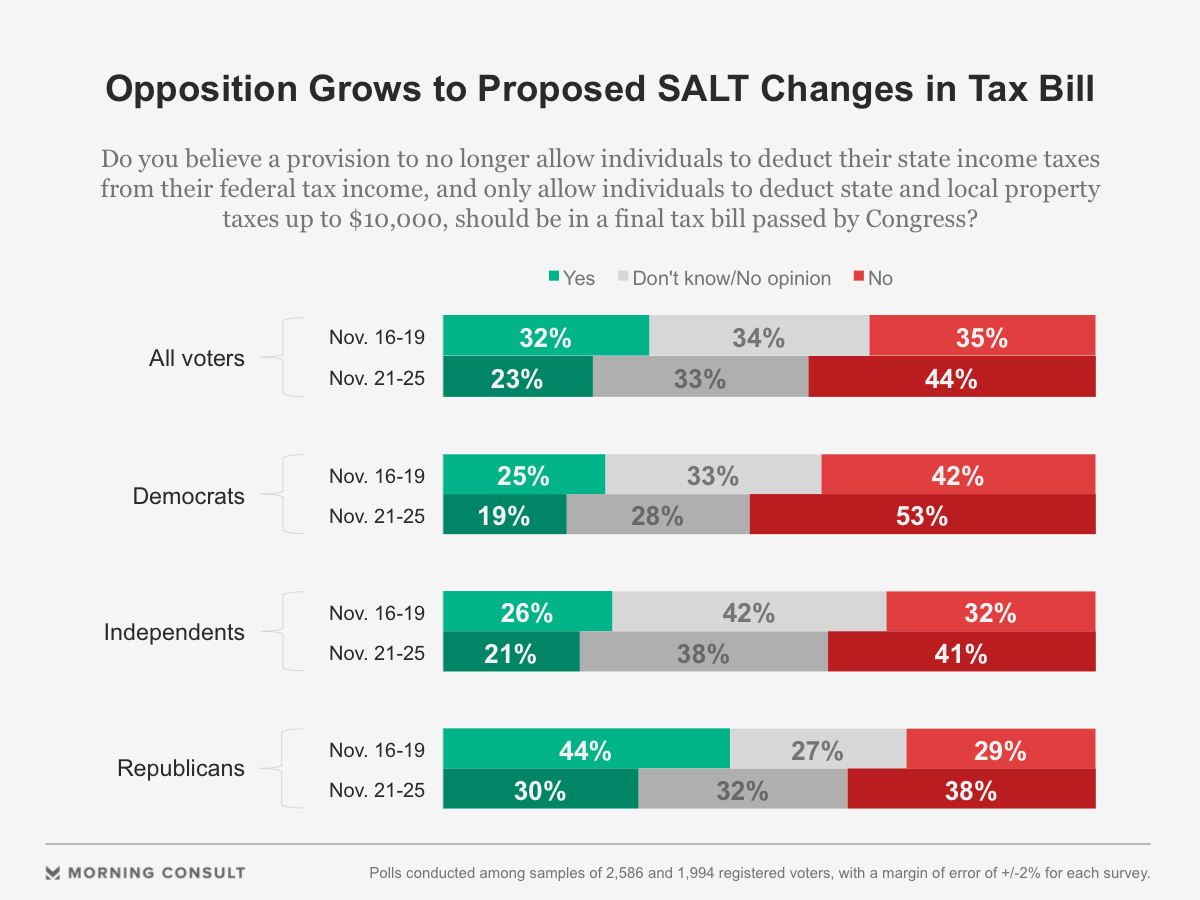

Voters Increasingly Oppose Proposed Salt Deduction Changes

What Is Salt Tax Deduction Mansion Global

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

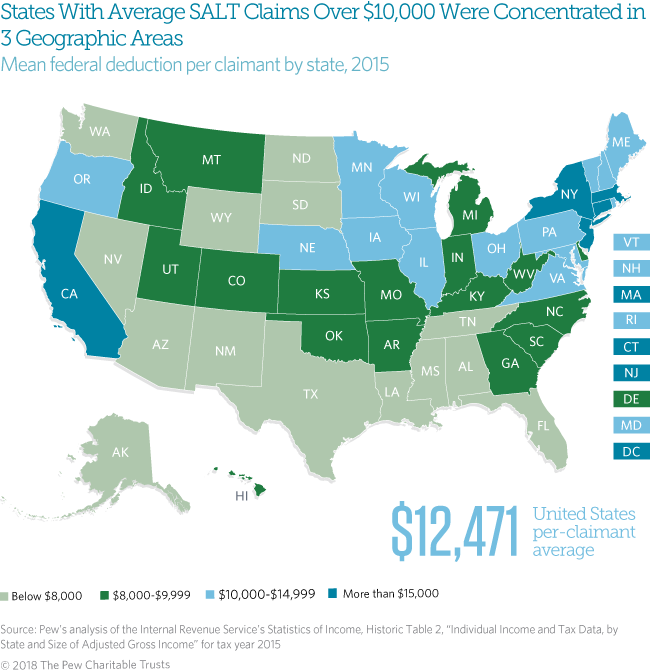

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

How Does The Deduction For State And Local Taxes Work Tax Policy Center