ct sports betting tax

The IRS code includes cumulative winnings from. If you lost 15000 on sports.

Connecticut Sports Betting Slips Again In July As Massachusetts Challenge Approaches

Proceeds will go to a college fund to allow students to attend Community College for free and also to fund some smaller municipalities in the state.

. That revenue is in addition to the 25 percent of gross slot revenues that the tribal. He celebrated Thursday with the Mohegan Sun and Foxwoods Resort Casino the opening day of sports betting in Connecticut. Online sportsbooks launched in the state to the general public on Oct.

The PlaySugarHouse Sportsbook service is operated by Rush Street Interactive CT RSI CT an affiliate of a US-based casino group Rush Street Gaming that owns and operates several leading land-based casinos in the US including the Des Plaines-located Rivers CasinoThe RSG group has been developing land-based casinos in North America since 1996 and fully understands the. The Connecticut General Assembly has more information available about the underlying bill House Bill 6451. It will likely help to bring Connecticut a huge amount of.

Sports betting losses are tax-deductible but under very specific conditions. Osten co-chair of the Appropriations Committee told CT Examiner that legislators expect about 80 million in additional revenue for the state from all new forms of gambling. Connecticuts tax coffers gained about 25 million from online casino gaming and 17 million from sports betting last month on a total of 4446 million in wagers.

Last week the state reported Februarys numbers for sports gambling in Connecticut. When will CT online sportsbooks launch. The most important of these conditions is that you cant claim losses that total more than your gains.

Depending on your state legal sports betting may be a combination of in person online retail at specifically licensed physical properties. At the statutory rate of 1375 reaching that number would require operators to generate around 180 million in combined revenue annually. 19000 and the.

How States Tax Sports Betting Winnings. Since PASPA was repealed by the Supreme Court in 2018 Connecticut has yet to push legislation that would bring sports betting to casinos. The final vote on HB 6451 was 122 to 21 with eight people.

The total amount owed for taxes on gambling winnings depends on the total amount earned by. How much revenue will CT sports betting generate. Retail sports wagering through the Connecticut Lottery began on October 25.

April 18 2022 Connecticuts three mobile sportsbooks combined for 1319 million in handle and 67 million in revenue during March. Thats not CT specific. This is a flat rate meaning that it applies to everyone winning money regardless of how much money they win and how much their annual income is.

The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax. That led to more than 1 million total taxes paid for the month.

24 Tax Withheld. Connecticut adopted emergency regulations Tuesday intended to speed the arrival of sports betting and online casino gambling. Many are still hopeful that Connecticuts first sports betting options will launch prior to the start of the 20212022 NFL season.

Ad New Customers Get up to a 1000 Deposit Bonus With DraftKings Today. Casino gambling and sports betting. The CT House of Representatives passed legislation regarding sports betting and online gaming in the state Thursday.

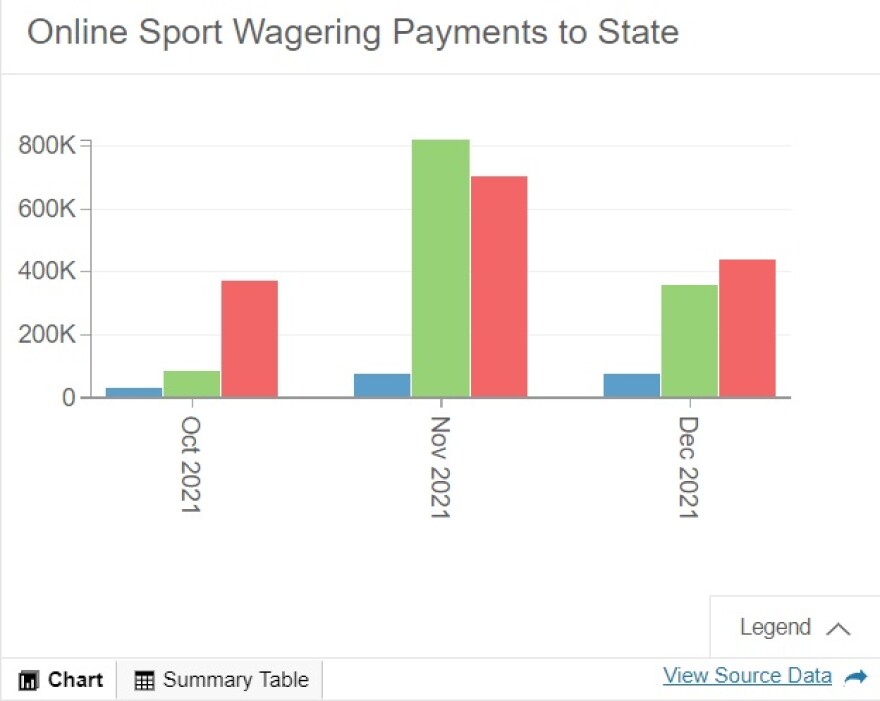

Pari-mutuel wagering is available on various off-track betting locations in Connecticut State. 18 online 1375 retail. Connecticut raked in more than 4 million in revenue from its nascent online gambling and sports wagering industry in November the first full month of legalized betting.

The Illinois sports betting tax rate is 495. Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. 12625 and the winners filing status for Connecticut income tax purposes is Single.

A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. The tax rate for sports betting will be 1375 on revenue. Legal sports betting in Connecticut is now live.

Sports betting tax rate. So if you lost 5000 on sports betting last year but took home 7000 in the end youd be able to deduct all of those losses. Bet Online From Anywhere in Connecticut With DraftKings.

Some of the OTB locations include. Gaming Revenue Statistics and Documents. States have set rules on betting including rules on taxing bets in a variety of ways.

The good news is that off-track betting is allowed in the state where people can place their wager on horse racing. DraftKings FanDuel and PlaySugarHouse all launched on the same day. Thats the expected amount that will be owed when it comes tax time each year but that doesnt mean its the amount that is actually owed.

The legislation is Public Act 21-23. The retail sportsbooks through the Connecticut Lottery added 88 million in handle and 827609 in revenue. The payment due to the state is 1375 of gross gaming revenue for sports wagering and 18 for online casino gaming until 2026 when it will increase to 20.

This amounted to 501516 of their total gross revenue which was 36. Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24. All three paid a total tax rate of 1375 of their gross revenue for sports betting in February.

19000 and the winner is filing head of household. The state does not collect payments on sports wagers placed on tribal lands. The combined sports betting handle was 1156 million for the states three licensees.

A 1375 tax on sports wagering and expansion of iLottery and Keno. The fiscal note attached to the bill projects as much as 248 million in annual tax revenue from CT sports betting by 2026. This season is expected to be the most-wagered-on one in history.

In fact every dollar you win gambling is taxable. The state will collect taxes. 13000 and the winner is filing single.

There are two proposed bills currently going through the. The standard amount withheld by sportsbooks to cover sports betting taxes on wins is 24. If you win 10 100 bets and lose 9 100 bets youll just get taxed on 100 net winnings.

Both the tribes and the Connecticut Lottery will pay the tax. 12000 and the winner is filing separately. 12000 and the winners filing status for Connecticut income tax purposes is Married Filing Separately.

A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds. That isnt the complete list of all gambling winnings that are taxable though. The companies will also pay a 1375 percent tax on sports and fantasy sports betting.

Regulation of Online Casino Gaming Retail and Online Sports Wagering Fantasy Contests Keno and Online Sales of Lottery Tickets. 24000 and the winner is filing. The losses can only be used to write off up to the amount you won even if you lose net.

Limited Online Gambling Starts In Connecticut Tuesday Here S How It Will Work And What This Means For Sports Betting Hartford Courant

Today Tip Is Available Now Inbox Me On Whatsapp 2347062491581 In 2022 Today Tips Books Online Tips

Tax Spend How Regulations Impact Igaming And Sports Betting Success Ggb Magazine

North Carolina Lawmakers Propose Increased Sports Betting Tax Rate

Casino Executives Argue Sports Betting Elsewhere Is Pulling Workers Out Of Massachusetts

Connecticut Icasino Sports Betting Numbers Grow

Mass Senate Passes Sports Betting Bill Wbur News

December Gambling Revenues Show Online Casino Gaming Trumps Sports Betting Connecticut Public

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

Online Sports Betting In New York Has Brought In Record Setting Revenue In First Six Months Wskgwskg

Gambling Pays Out A 38 Billion Bonus To Tax Collectors Winning Lottery Numbers Lucky Numbers For Lottery Lottery Numbers

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

Animal Kingdom Winner Of The 2011 Kentucky Derby Horses Beautiful Horses Derby Horse

Good Health Health Sport Body Dua For Good Health Health Health Tips

Nfl Players To Watch In Training Camp Nfl Players Jets Football Chris Johnson

December Gambling Revenues Show Online Casino Gaming Trumps Sports Betting Connecticut Public

December Gambling Revenues Show Online Casino Gaming Trumps Sports Betting Connecticut Public